what is fsa health care 2022

An FSA is a type of savings account that provides tax advantages. We Have Your Lenses In Stock-Fast Shipping.

The 2022 Fsa Contribution Limits Are Here

An FSA is a kind of employer-sponsored spending account that enables workers to put aside pretax earnings to pay for qualifying health care and dependent care expenditures.

. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. Medical FSA The Medical FSA allows you to set aside pretax money from your paycheck for out-of-pocket health care costs like deductibles copays. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

So if you had 1000 in your account at the end of this year you could carry it all over into 2022. Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices. An FSA helps take the sting out of paying for medical treatment and dependent care.

An FSA is a tax-advantaged way for you to pay for certain medical expenses. Everything from medical expenses that arent covered by a health plan like deductibles and co. The 2022 limits are good to know for planning purposes ECFCs Sweetnam said Employers generally start talking to their employees about making health care.

Elevate your health benefits. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. If you have a dependent care FSA pay special attention to the limit change.

Common purchases include everyday health care products like bandages thermometers and glasses. This means youll save an amount equal to the taxes you would have paid on the money you set aside. The usual carry-over limit is 550.

2022 information About Navia Benefit Solutions Navia Benefit Solutions administers the Medical Flexible Spending Arrangement FSA Limited Purpose FSA and Dependent Care Assistance Program DCAP for the SEBB Program. Below find out how the. You cannot use the dependent care fsa to reimburse for health care expenses incurred by a dependent.

For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of the american rescue plan act of 2021 and that change has not been. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. You dont pay taxes on this money.

Heres how a health and medical expense FSA works. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year. Ad We Beat Any Price on Contacts.

Each paycheck contains pretax monies that are automatically placed into an FSA account. Employers may make contributions to your FSA but. A Health Flexible Spending Account also known as an FSA is a type of pre-tax benefit where you receive significant savings on medical dental and vision expenses for you and your eligible dependents.

On November 10 2021 the IRS announced the maximum 2022 contribution limits for health care flexible spending accounts FSAs and limited purpose FSAs commuter benefits and adoption assistance. Dave Dillon FSA MAAA Expand search. Easiest Way to Order Contacts.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. These expenses arent covered by your employers health insurance plan but they are eligible. Health Insurance Actuary and Affordable Care Act Expert Published Jun 30 2022 Follow The state of the United States healthcare system today is one the.

Ad Join 2 Million Satisfied Shoppers weve Helped Cover. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. The Health Care Flexible Spending Account HCFSA Program allows City employees to pay for eligible out-of-pocket health care expenses on a pre-tax basis with deductions taken directly from salary.

The IRS announced that for plan year January 1 through December 31 2022 federal employees can contribute 100 more into their health care flexible spending account HCFSA or limited expenses health care flexible spending account LEXHCFSA during 2022 compared to what they could contribute during plan year 2021. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. An FSA is not a savings account.

Employees choose how much they want to donate for the year tax-free. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses. The limit is expected to go back to 5000.

Get a free demo. Get a Quote Now. You can use this account for these types of expenses and you can use it to pay for everything from prescriptions to dental treatments.

FSAs only have one limit for individual and family health plan participation but. Employers set the maximum amount that you can contribute. However it cant exceed the IRS limit 2750 in 2021.

Its a smart simple way to save money while keeping you and your family healthy and protected. Affordable Healthcare Coverage for Families Individuals. Easy implementation and comprehensive employee education available 247.

The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing. Flexible Spending Accounts program - new 2022 limits for the HCFSA and LEX HCFSA. For 2022 participants may contribute up to an annual.

But the late announcement left. As a result the IRS has revised contribution limits for 2022. An FSA is a tool that may help employees manage their health care budget.

The Flexible Spending Account FSA is a much sought-after benefit in 2021 as people return to doctors and hospitals for treatment they delayed receiving in 2020 because of the pandemic. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA. Plan Year 2022 Annual Open Enrollment Period.

Check the Newest Plan Options. You decide how much to put in an FSA up to a limit set by your employer. Dependent Care Fsa Limit 2022 Hce.

A Limited Purpose Flexible Spending Account LPFSA is a pre-tax benefit used to pay for eligible dental vision care and post-deductible medical expenses for participants enrolled in a High Deductible Health Plan HDHPA Limited Purpose Flexible Spending Account LPFSA is a pre-tax benefit used to pay for eligible dental vision care and post-deductible medical expenses for. Ad Custom benefits solutions for your business needs. Never Run Out of Contacts.

When used it can be a great tax savings tool to effectively pay for.

Hra Vs Fsa See The Benefits Of Each Wex Inc

Flexible Spending Account Contribution Limits For 2022 Goodrx

Best Deals And Coupons For Lenscrafters Lenscrafters Sale Design Sunglasses Branding

Otc Card Eligible Items At Walmart Dear Adam Smith In 2022 Health Savings Account Prepaid Credit Card Walmart

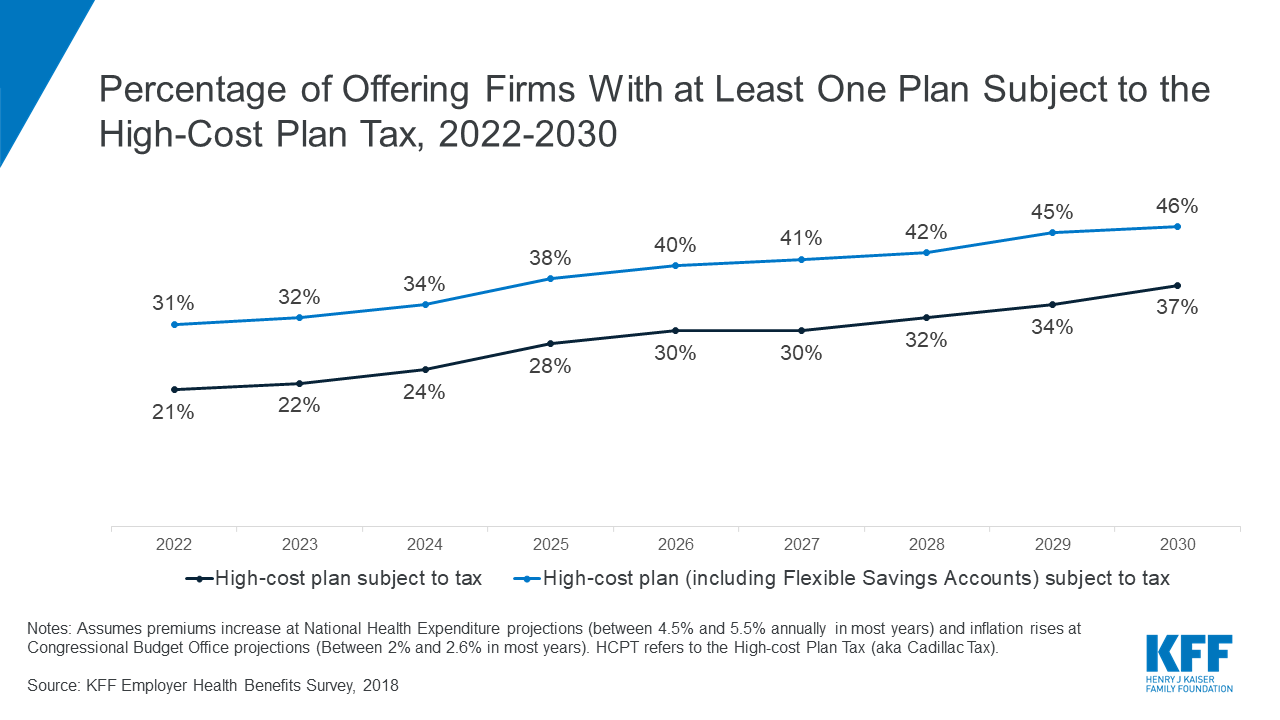

How Many Employers Could Be Affected By The High Cost Plan Tax Kff

What Is An Fsa Definition Eligible Expenses More

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Irs Releases Fsa Contribution Limits For 2022 Primepay

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

How I M Using The Qsehra Managed By Take Command Health To Deduct My Employees Healthcare Benefit Best Health Insurance Medical Health Insurance Free Health Insurance

Kirkland Signature Nondrowsy Allerclear Antihistamine 10mg 365 Tabletsdefault Title In 2022 Herbal Supplements Tablet Allergies

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Always Discreet Size 6 Extra Heavy Absorbency Long Women S Incontinence Pads 90 Count In 2022 Incontinence Pads Incontinence Incontinence Products Woman

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is Hipaa Compliance Read Our Hipaa Compliance Checklist Guide For 2021 Everything Hipaa Compliance Health Information Management Healthcare Compliance

Brene Brown In 2022 Podcasts Bilingual Songs Brene Brown

Flexible Spending Account Contribution Limits For 2022 Goodrx

A Quick Guide To Flexible Spending Accounts Accounting Health Savings Account Flexibility